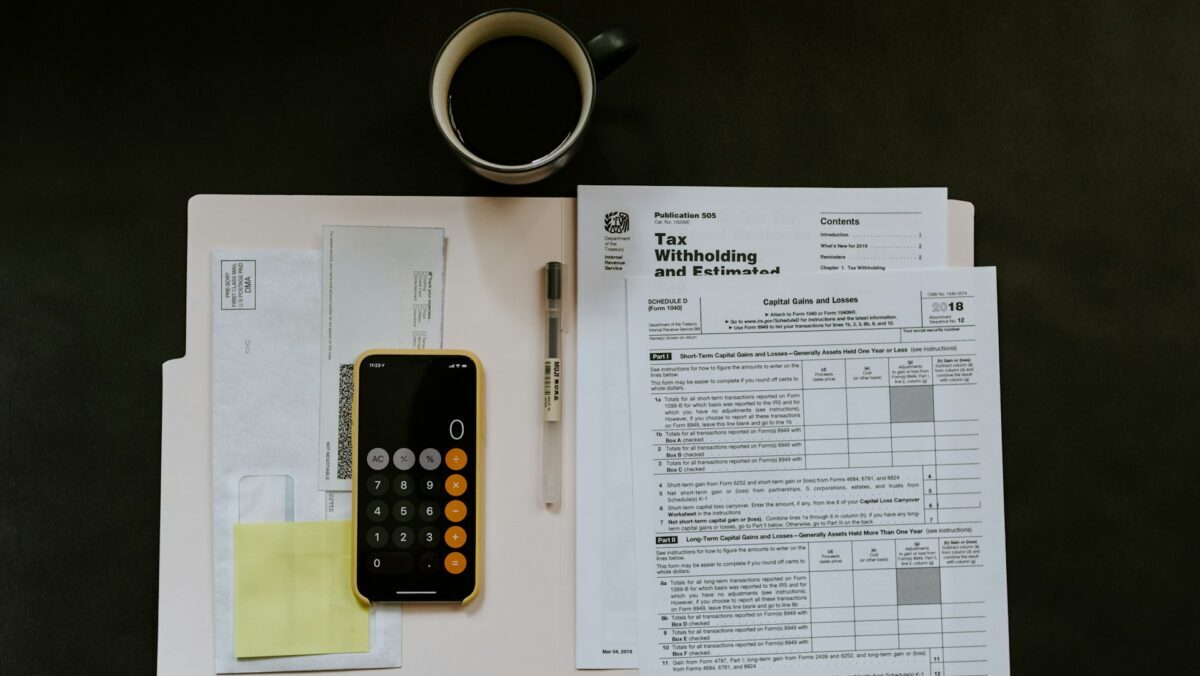

Schedule D For 2024 Tax – By law, the IRS must wait until at least mid-February to issue refunds to taxpayers who claimed the earned income tax credit or additional child tax credit. According to the agency, those payments . The 2024 tax-filing season kicked off on Jan. 29 The two volunteer groups do not help prepare tax returns on Complicated Schedule D (capital gains and losses), Schedule C with loss, depreciation .

Schedule D For 2024 Tax

Source : kdvr.comWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

Source : finance.yahoo.comWhat happened to Schedule C? (Q Mac) — Quicken

Source : community.quicken.com2024 Tax Update and What to Expect

Source : sourceadvisors.comThe 2024 Cost of Living Adjustment Numbers Have Been Released: How

Source : rjicpas.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.comFree Tax Clinic Bethpage VITA at Touro Law University – Nassau

Source : www.nslawservices.orgConsumer Bill of Rights Regarding Tax Preparers

Source : taxtodd.comNorth Miami Public Library (@nomilibrary) • Instagram photos and

Source : www.instagram.com2024 tax season: Pastors, here’s your step by step guide The

Source : thebaptistpaper.orgSchedule D For 2024 Tax New IRS Schedule D Tax Form Instructions and Printable Forms for : When it comes to receiving your tax refund, timing varies based on several factors. According to the IRS, most refunds are issued within 21 days, but certain situations can cause d . The Internal Revenue Service (IRS) has released the tax refund schedule for the year 2024. TRAVERSE CITY, MI, US, January 22, 2024 /EINPresswire.com/ — The Internal .

]]>